In the latest market analysis, Asia-Pacific markets experienced a decline following the drop in Wall Street. Investors are eagerly awaiting the release of gross domestic product reading and inflation numbers from the U.S. market. Despite the overall downward trend, Hong Kong's Hang Seng index managed to reverse earlier losses and close with a slight increase. Meanwhile, the mainland Chinese CSI 300 index closed higher, driven by positive economic indicators. Australia's S&P/ASX 200 and Japan's Nikkei 225 both experienced significant drops due to safety scandals at automaker Toyota. South Korea's Kospi and Kosdaq also saw a decline, ending their winning streak. Stay informed on the latest market trends and economic indicators to make informed investment decisions.

Asia-Pacific Markets Respond to Wall Street's Drop

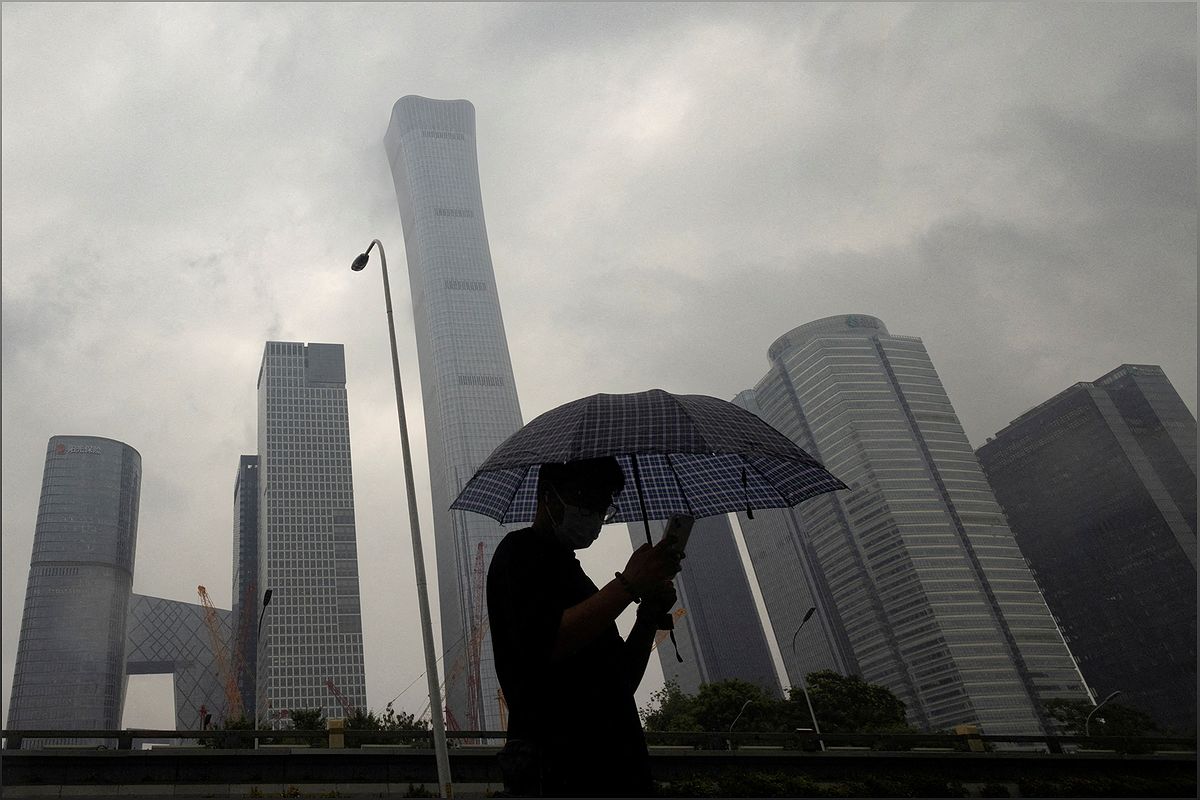

Following the drop in Wall Street, Asia-Pacific markets experienced a downward trend. Investors were cautious as they awaited the release of key economic indicators from the U.S. market. However, Hong Kong's Hang Seng index managed to reverse earlier losses and close with a slight increase, providing some respite amidst the overall decline.

The mainland Chinese CSI 300 index also closed higher, indicating positive sentiment in the market. Economists are closely monitoring these developments to gauge the overall health of the global economy.

Impact of Safety Scandals on Automaker Toyota

Japanese automaker Toyota faced significant losses on the Nikkei 225 index following safety issues with its subsidiary, Daihatsu, and airbags. The announcement of a recall for one million vehicles further eroded investor confidence.

Investors are concerned about the impact of these safety scandals on Toyota's reputation and the potential financial implications for the company. The market will closely monitor Toyota's response and any regulatory actions that may follow.

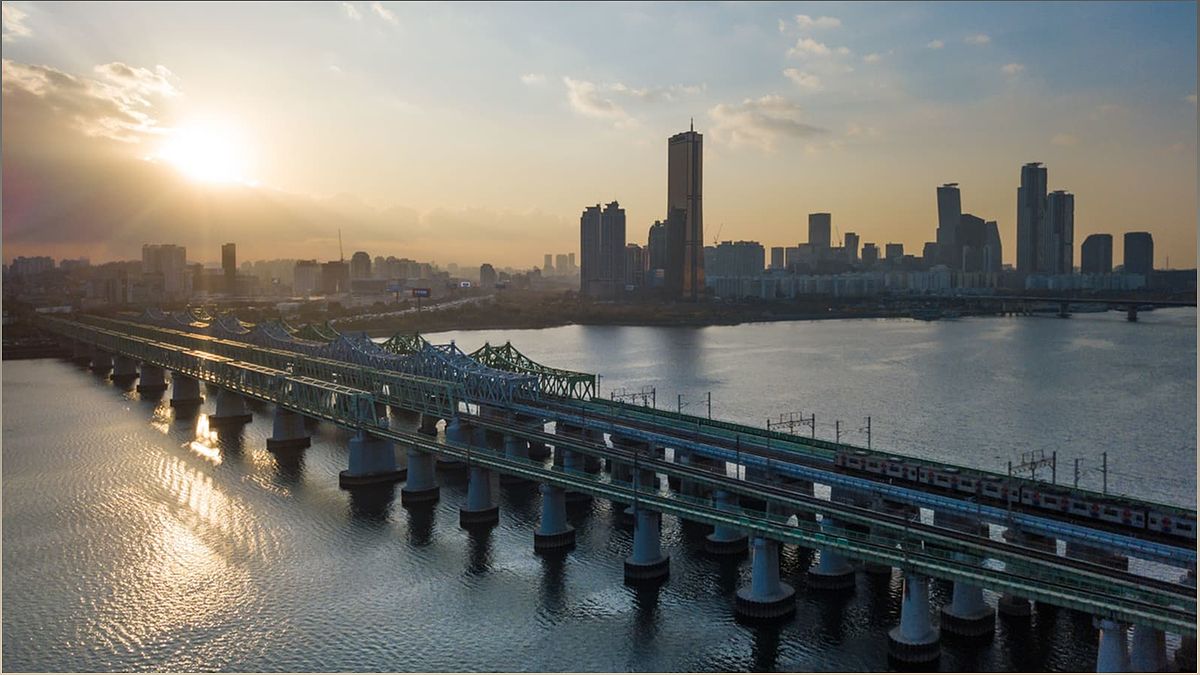

South Korea's Producer Prices Experience Slowest Rise in Months

South Korea's producer prices recorded a slower rise in November, marking the slowest increase in four months. This data indicates a potential slowdown in the country's industrial sector.

Economists are closely monitoring these figures as they provide insights into the overall health of the South Korean economy. The fluctuation in producer prices may impact consumer spending and business investment, which will have broader implications for the country's economic growth.

Market Outlook and Investment Strategies for 2024

As investors navigate the uncertainties of 2024, including the possibility of a recession and geopolitical risks, it is crucial to develop a diversified investment portfolio. Experts recommend analyzing market trends and economic indicators to make informed investment decisions.

By staying updated on the latest market analysis and understanding the potential impact of global events, investors can position themselves for success in the year ahead. It is important to consider factors such as interest rates, inflation, and industry-specific trends when formulating investment strategies.

Oil Prices and Geopolitical Concerns

Oil prices experienced fluctuations as traders weighed record U.S. production against threats to shipping in the Red Sea. Concerns over disruptions in crude supply due to militant activities in Yemen added volatility to the market.

Additionally, traders shifted their focus to concerns of oversupply as the U.S. reached record levels of crude production. These factors contribute to the overall uncertainty in the oil market and can have a significant impact on global energy prices.