Welcome to this article where we will delve into the dividend performance and sustainability of Severn Trent PLC. As an experienced content writer in the financial industry, I will provide you with insights into the company's dividend history, growth rates, and profitability. By the end of this article, you will have a better understanding of whether investing in Severn Trent PLC's dividends is a wise choice. Let's get started!

Severn Trent PLC's Dividend History

Explore the consistent dividend payment record of Severn Trent PLC since 2011 and its distribution frequency.

Severn Trent PLC has maintained a consistent dividend payment record since 2011. Dividends are currently distributed on a bi-annual basis.

Breaking Down Severn Trent PLC's Dividend Yield and Growth

Analyze Severn Trent PLC's dividend yield, growth rates, and their implications for investors.

As of today, Severn Trent PLC currently has a 12-month trailing dividend yield of 4.10% and a 12-month forward dividend yield of 4.33%. This suggests an expectation of increased dividend payments over the next 12 months.

Over the past three years, Severn Trent PLC's annual dividend growth rate was 2.70%. Extended to a five-year horizon, this rate increased to 4.50% per year. And over the past decade, Severn Trent PLC's annual dividends per share growth rate stands at 3.60%.

Based on Severn Trent PLC's dividend yield and five-year growth rate, the 5-year yield on cost of Severn Trent PLC stock as of today is approximately 5.11%.

The Sustainability Question: Payout Ratio and Profitability

Assess the sustainability of Severn Trent PLC's dividend by evaluating its payout ratio and profitability.

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. As of 2023-09-30, Severn Trent PLC's dividend payout ratio is 2.67, which may suggest that the company's dividend may not be sustainable.

Severn Trent PLC's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks Severn Trent PLC's profitability 7 out of 10 as of 2023-09-30, suggesting good profitability prospects. The company has reported net profit in 9 years out of the past 10 years.

Growth Metrics: The Future Outlook

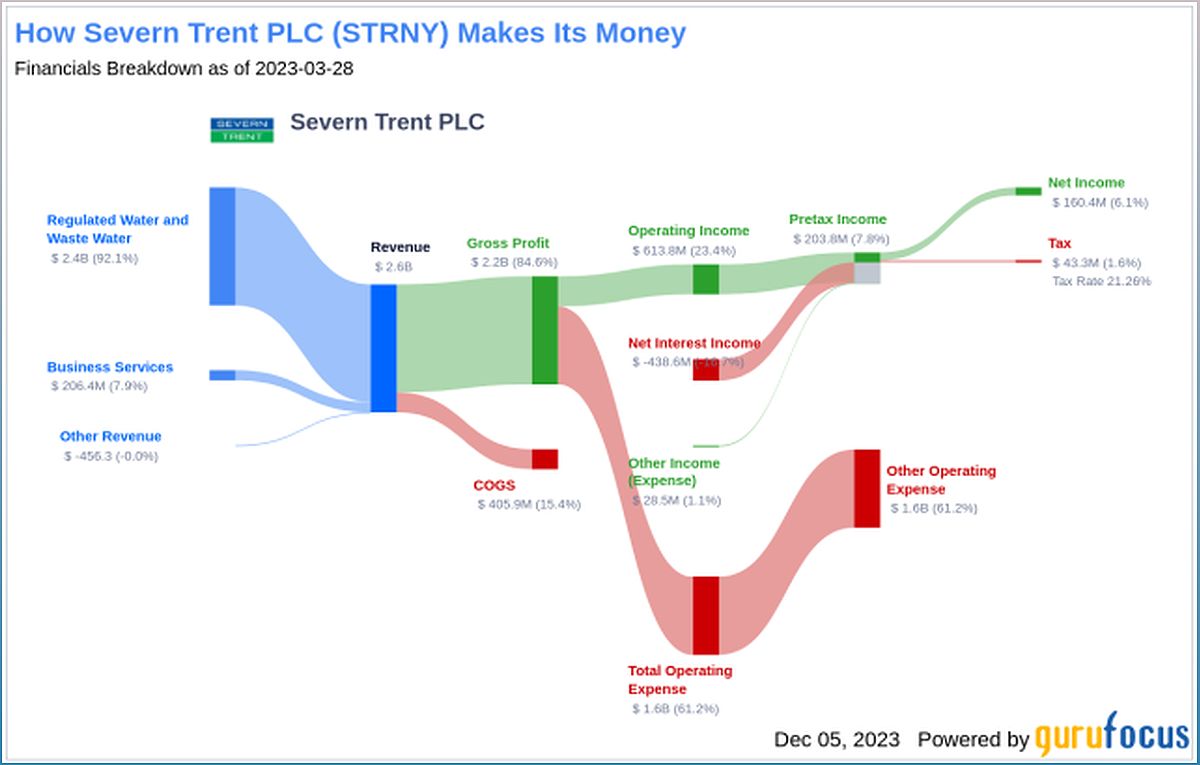

Examine Severn Trent PLC's growth metrics, including revenue and earnings growth rates, to gauge its future prospects.

To ensure the sustainability of dividends, a company must have robust growth metrics. Severn Trent PLC's growth rank of 7 out of 10 suggests that the company's growth trajectory is good relative to its competitors.

Revenue is the lifeblood of any company, and Severn Trent PLC's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Severn Trent PLC's revenue has increased by approximately 3.70% per year on average, a rate that underperforms approximately 70.02% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Severn Trent PLC's earnings increased by approximately -26.30% per year on average, a rate that underperforms approximately 87.47% of global competitors. Lastly, the company's 5-year EBITDA growth rate of -13.90%, which underperforms approximately 88.17% of global competitors.

Investing in Severn Trent PLC's Dividends: A Wise Choice?

Evaluate the factors discussed to make an informed decision about investing in Severn Trent PLC's dividends.

In conclusion, while Severn Trent PLC has a history of consistent dividend payments and a reasonable yield, potential investors should be cautious due to the company's high payout ratio and underperforming growth metrics.

The profitability rank does provide some assurance of the company's financial health, but the negative growth rates in revenue and earnings may raise questions about the long-term sustainability of the dividend.

Investors considering Severn Trent PLC should weigh these factors and monitor the company's future performance to ensure their investment aligns with their financial goals.

For those interested in exploring further, GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.