International investors are showing a newfound interest in India's stock market, signaling a potential shift in long-term investment strategies. As India's stock market reaches record highs and surpasses Hong Kong in market value, investors are drawn to its potential for growth and stability. This article explores the factors driving this surge in interest, including India's economic resilience and its appeal as a business destination. While concerns about election-related uncertainty and the broader economy persist, India's market continues to attract attention from global investors. Stay informed about the latest developments in India's stock market and its potential for long-term investment opportunities.

Growing Interest from International Investors

India's stock market is attracting significant attention from international investors, including family offices in Europe and large investors in the US. This newfound interest marks a shift in long-term investment strategies, as investors are drawn to the potential growth and stability offered by India's market.

Questions about the safety of investments and the rule of law in India are being raised as investors explore the opportunities in the country. With India's stock market hitting record highs and surpassing Hong Kong in market value, investors are comparing its potential to China's growth in the early 2000s.

Factors Driving the Surge in Interest

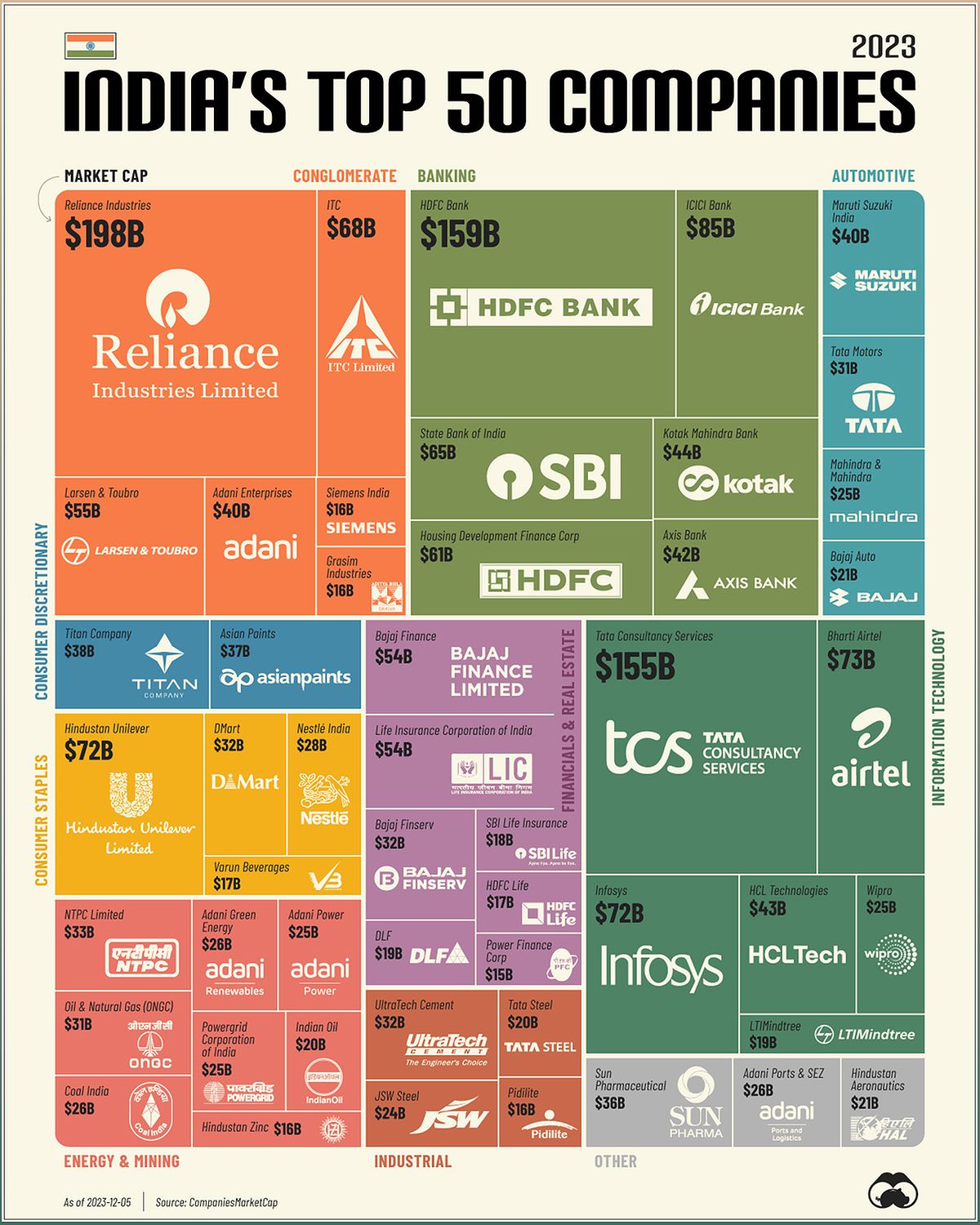

India's stock market has experienced remarkable growth, with the market value of listed companies crossing $4 trillion. This places India as the seventh-largest stock market in the world, highlighting its potential as an attractive investment destination.

The positive sentiment towards India is fueled by its resilience to global economic risks and its limited economic linkage to China's end demand. Additionally, the country has seen a surge in initial public offerings and domestic flows, which are expected to support the market and mitigate downside risks.

India's Appeal Compared to Other Economies

India's stock market's buoyancy stands in contrast to concerns over China's economy, making it an attractive alternative for investors. The country is seen as less exposed to global economic risks and offers a more stable investment environment.

Moreover, India's economic slowdown and tensions between China and the US have positioned India as a promising business destination for Japanese manufacturers. The country's potential for growth and stability have surpassed China in the eyes of many investors.

Election-Related Uncertainty and Economic Concerns

The upcoming elections in India may introduce a level of uncertainty for foreign investors. However, Prime Minister Narendra Modi's ruling party is expected to win, ensuring political stability in the country.

Despite concerns about a potential slowdown in India's economy, including debt-fueled private consumption and distress in the labor market, the stock market's positive sentiment remains. Critics argue that the market's buoyancy does not accurately reflect the broader economy's challenges in creating suitable jobs and achieving sustainable and inclusive growth.